Manage your company's finances

Complexity in financial planning is driven by a variety of factors, such as fluctuations in turnover, or investments and loans.

These challenges call for precision and flexibility to ensure your business is always solvent and profitable.

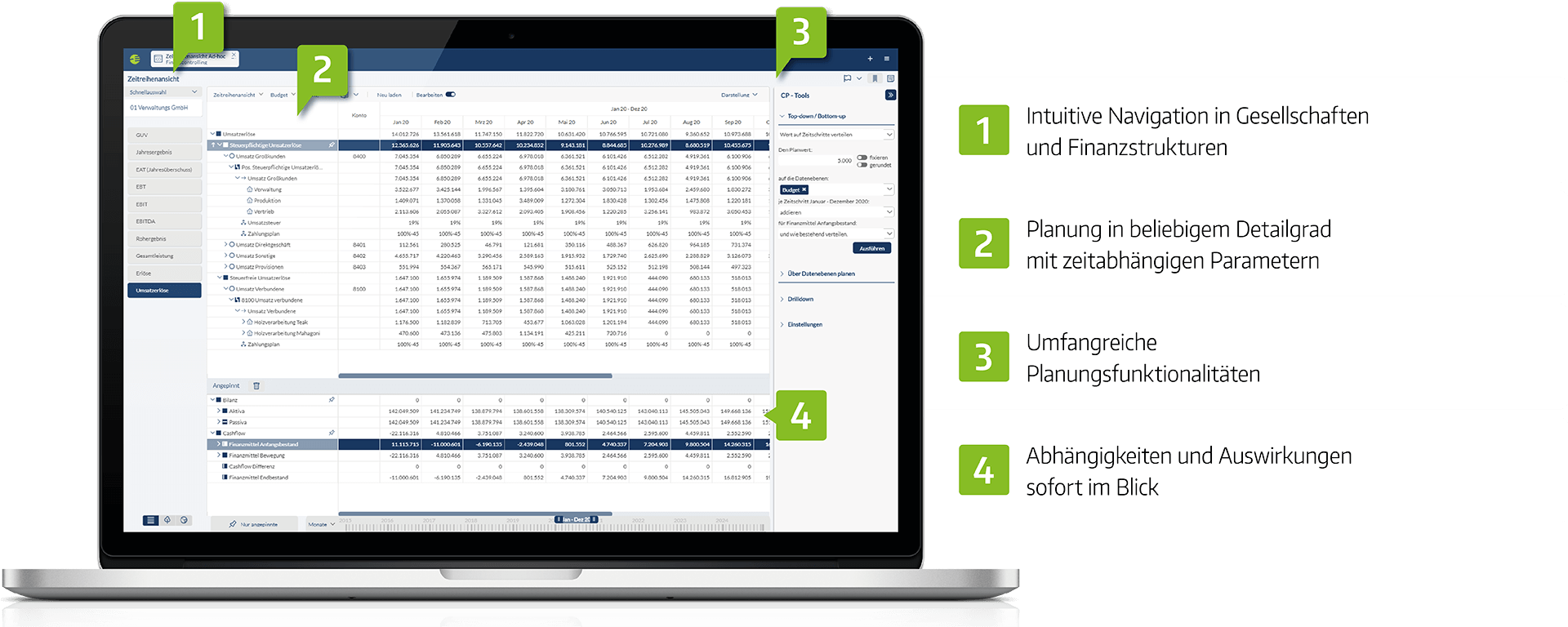

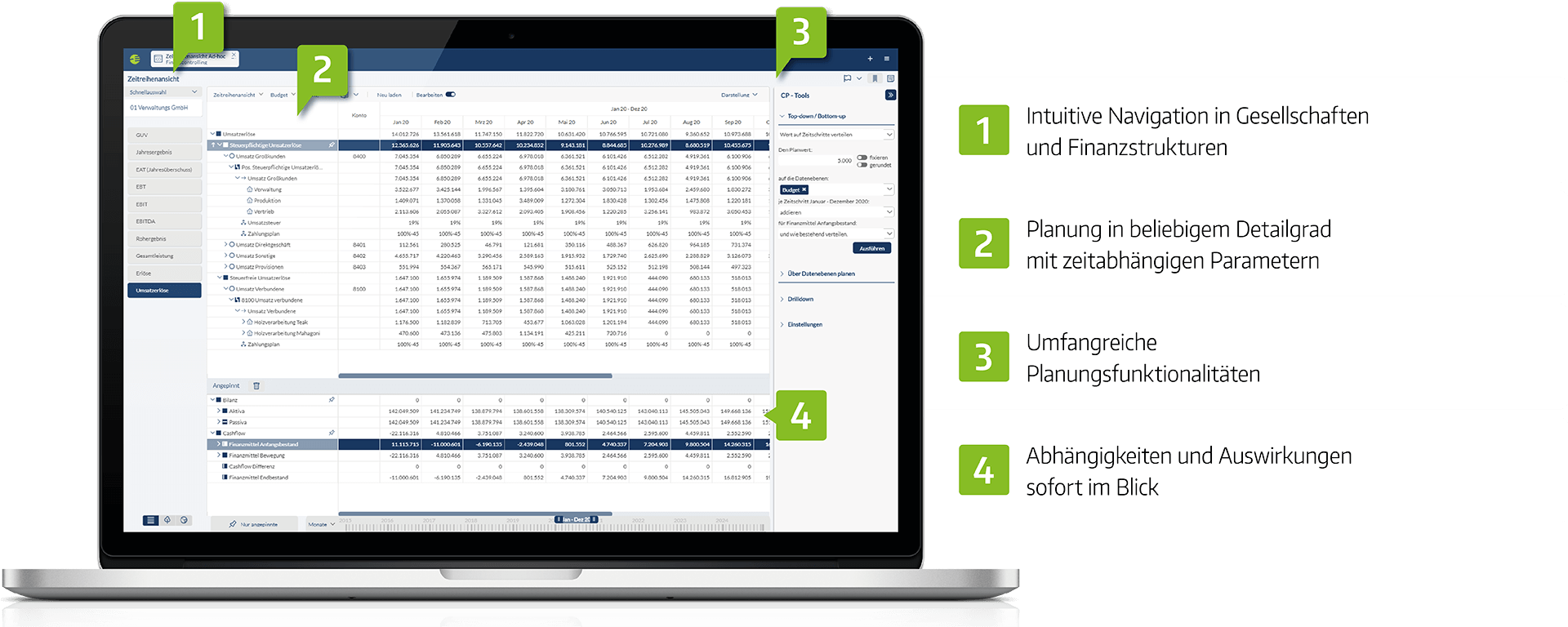

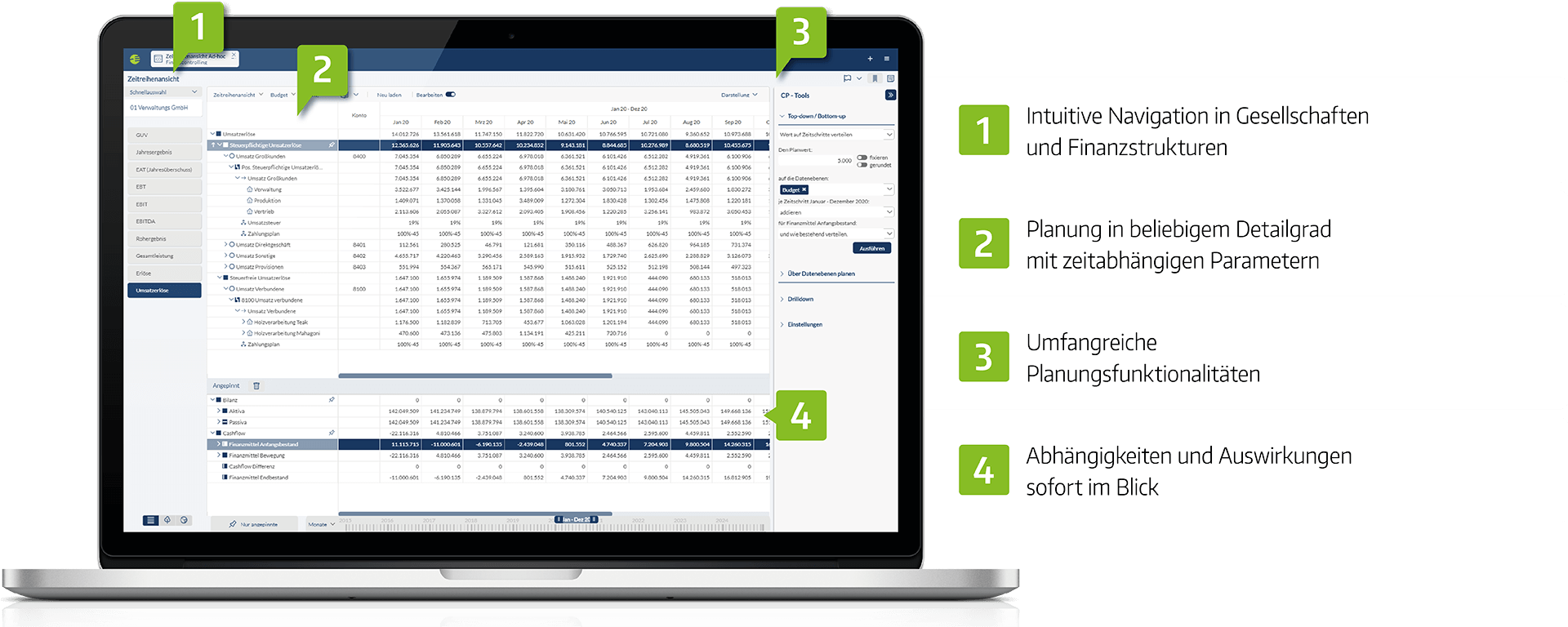

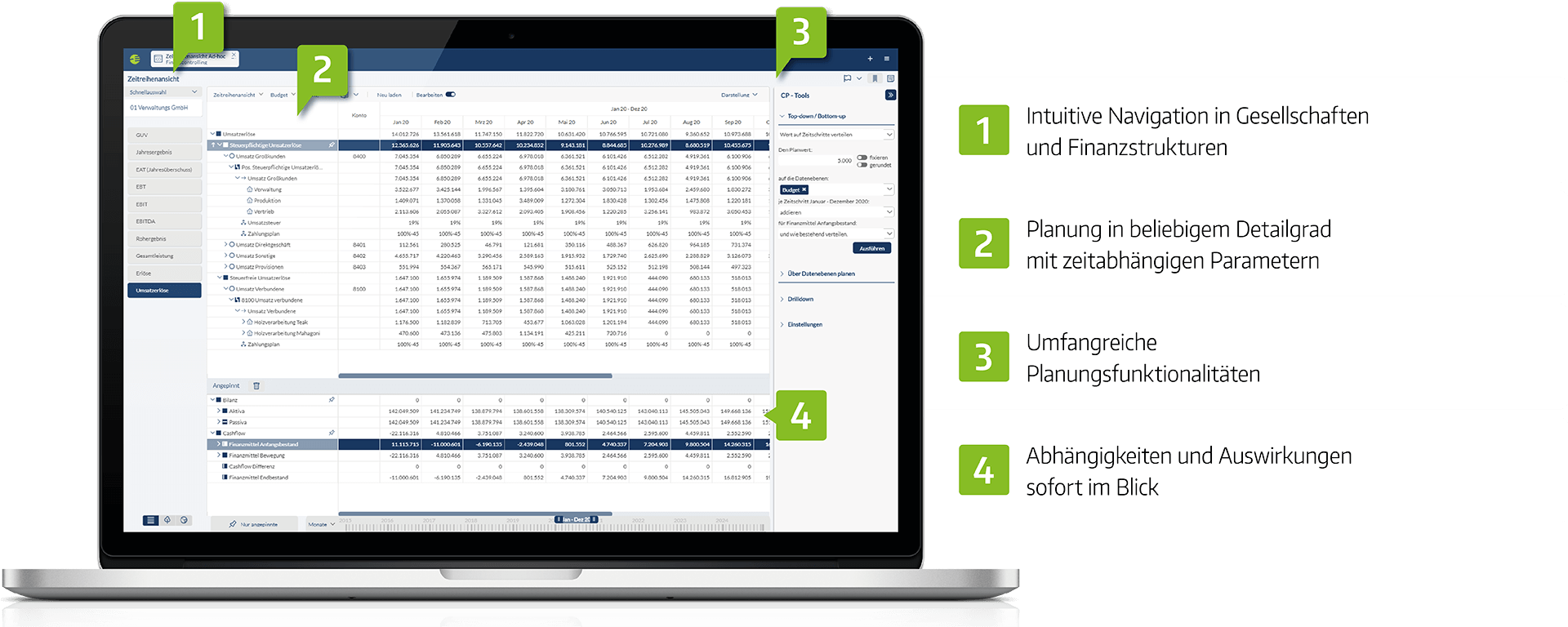

Corporate Planner provides an integrated platform that enables you to automate and optimize your company's financial planning. Easily merge your operational budgets and see straight away how they affect the P&L, cash flow and balance sheet. With live forecasting and scenario planning functions as well as automated data integration, our software gives you the transparency and efficiency you need for successful financial management.

Transparency brings stability to your financial planning

-

Corporate Planner

×

×

All areas of financial management

Liquidity management

Take an agile approach to your liquidity management. In our software, your P&L, balance sheet and cash flow statement are dynamically interlinked, so you can easily track the development of your company's liquidity over time and make sound decisions.

Income statement (P&L)

Plan your company's P&L at any level of detail in Corporate Planner. Our software provides you with all the functions you need, while also taking the business context into account – for more efficiency in your planning and analysis.

Fixed asset management

Plan the deployment of your financial resources and analyse how sustainable an investment has been. Our software provides you with the functions you need for managing fixed assets and loans, calculating depreciation and repayments, and planning best-case and worst-case scenarios.

Financial controlling product sheet

Here you will find the product sheet in PDF format for Corporate Planning. You can view or download the data sheet directly on screen. Would you like to find out more about how you can exploit the full potential of financial controlling? Arrange a consultation or demonstration with one of our consultants.

Advantages of the Corporate Planning solution

With Corporate Planner, companies are excellently equipped for efficient, precise financial planning, so they can safeguard their long-term financial stability and growth.

A real-world example

This mid-sized company has improved its cash flow forecasts and has been making quicker, more confident investment decisions since implementing Corporate Planner.

Corporate performance management software

at work

What do the Corporate Planning software solutions deliver in practice? Nobody's better placed to tell us than the people working with them every day. Here's what some of our customers have to say.

The flexible, high-performance Corporate Planning software solution enables us to model all our processes and scenarios much more easily from start to finish. We were also impressed by the fact that no programming knowledge is required to create new reports.

Anja Tripolt

Head of Controlling, Schrack Seconet AG

The Corporate Planning software pools all our data sources and, thanks to its tree structure, provides a good overview. Navigation in the data sets is clear and simple, and KPIs for reporting can be set up quickly in a way that's easy to understand.

Elisabeth Kreuzer

Head of Finance and Legal, Brüder Theurl GmbH

We've been using Corporate Planner for more than twenty years. The solution is ideal in that it enables us to visualize new and increasing demands again and again. We greatly appreciate this flexibility and the ongoing development of the Corporate Planning software.

Stefan Dittmann

Senior Controller, digades GmbH

The Corporate Planning software is easy to use and also visually appealing. The business logic in Corporate Planner Finance enables a rapid rollout, so the software can be used straight away.

Nils Bublitz

Head of Group Accounting, Böcker Maschinenwerke GmbH

All about financial management

-

Financial management is a central component of corporate performance management, which deals with the planning, control and monitoring of all the financial processes within a company. Its purpose is to safeguard the company's financial stability and profitability, as well as to provide reliable analyses and reports as a sound basis for decision-making.

-

The main tasks of financial management:

-

Planning:

- Creating financial plans, budgets and forecasts for sales, costs, investments and liquidity.

- Developing long-term financial strategies to achieve the company's financial goals.

-

Control:

- Monitoring and management of financial resources to ensure that targets are met.

- Managing the company's liquidity to safeguard its solvency.

-

Monitoring:

- Target-actual comparisons to identify variances from the financial plan.

- Analysis of variances and implementation of corrective measures.

- Monitoring compliance with budgets and financial objectives.

-

Reporting:

- Providing managers with financial reports and KPIs so they can make informed decisions.

- Preparation of reports for external stakeholders, such as investors and lenders.

-

Analysis:

- Performing profitability and liquidity analyses to assess the company's financial position.

- Identification of risks and opportunities in the company's financial development.

KPIs in financial management:

- Turnover: the total revenue of the company.

- Profit/Loss: the difference between the income and the expenditure.

- Liquidity: the company's ability to meet its payment obligations.

- Equity Ratio: the share of equity in the company's total assets.

- Return on Investment (ROI): the return on the capital employed.

Financial management is crucial for ensuring economic efficiency and helping companies to safeguard their long-term success. It delivers the transparency you need for managing financial risks and making your company fit for the future.

-

-

The main tools of financial management

-

Budgeting:

- Preparation of detailed financial plans for a specific period in order to plan income, expenditure and investments.

- The budget serves as a guideline for financial management and sets targets against which regular target-actual comparisons are carried out.

-

Financial planning:

- Short, medium and long-term planning of financial resources to ensure that the company can achieve its goals. This includes liquidity planning, investment planning and debt capital planning.

-

Liquidity management:

- Ensuring the company's solvency by monitoring cash inflows and outflows.

- A liquidity plan or a cash flow plan can be used to help avoid future bottlenecks and ensure day-to-day solvency.

-

Cost accounting:

- The record and analysis of all costs in the company to identify potential savings and improve profitability.

- This involves analysing various types of costs, such as fixed and variable costs or overhead and direct costs.

-

Investment appraisal:

- Investment profitability analysis to determine whether a planned investment will pay off in the long term.

- Methods such as payback period, net present value, internal rate of return and return on investment (ROI) can be used.

-

Target-actual comparison:

- Comparison of the planned financial results with those which were actually achieved, in order to identify variances and take appropriate measures in good time.

- This helps when managing and adjusting budgets and financial strategies.

-

Break-even analysis:

- Calculation of the point at which a company's income covers its costs, so that a loss is no longer being made. This is particularly useful when making decisions on pricing and production volume.

-

Variance analysis:

- Detailed analysis of the differences between planned and actual figures (e.g. sales, costs, profit) in order to identify causes and determine any need for action.

-

Risk and opportunity management:

- Identification, assessment and control of financial risks (e.g. currency risks, interest rate fluctuations), and taking advantage of financial opportunities.

-

-

Profitability ratios:

- Return on Investment (ROI): shows the ratio of profit to capital employed.

- Return on Equity (ROE): measures the return on the company's equity.

- Return on Assets: shows the efficiency of the use of equity and debt capital.

Liquidity ratios:

- Cash Ratio: the ratio of cash and cash equivalents to current liabilities.

- Quick Ratio: measures the company's ability to cover its current liabilities with current receivables and cash and cash equivalents.

- Cash Flow: shows how much money the company generates from its operating activities. This states how much capital is actually available.

Debt ratios:

- Gearing: the ratio of borrowed capital to equity. This shows the company's dependence on borrowed capital.

- Interest Coverage Ratio: the ratio of earnings before interest and taxes (EBIT) to interest expenses. This shows how well a company can finance its interest payments from its operating activities.

Turnover and cost ratios:

- Return on Sales: shows what percentage of sales remains as profit.

- Contribution Margin: the difference between the sales generated and the variable costs. This shows how much the sales contribute to covering the fixed costs and to the profit.

Value-based ratios:

- Economic Value Added (EVA): measures the increase in value generated over and above the cost of capital.

- Return on Capital Employed (ROCE): measures the profitability of capital employed.

-

Professional financial management software, such as Corporate Planner, offers companies considerable advantages by making financial processes more efficient and transparent. Software solutions such as these help finance departments to plan, analyse and report more efficiently and make better decisions based on the latest data. Here are some of the advantages that professional corporate performance management software – Corporate Planner in particular – has to offer in financial management:

1. Centralized, integrated data

- Data integration: Corporate Planner can easily integrate data from various sources, e.g. ERP systems, financial accounting systems or external databases. This brings together all financial data on one central platform, ensuring a consistent and up-to-date data source.

- Single point of truth: all financial information is available in real time, consolidated for greater data consistency and accuracy.

2. Automation of processes

- Increased efficiency through automation: recurring tasks such as creating reports, plans and forecasts are easily automated. This saves time and reduces manual errors.

- Automated reporting: Corporate Planner can generate reports and distribute them to various stakeholders automatically, eliminating the need for manual data processing.

3. Flexible, dynamic planning

- Rolling forecasts and scenario analyses: Corporate Planner supports dynamic planning models, such as rolling forecasts, in which the plans are adjusted on an ongoing basis. Our software can also perform scenario analyses to test various assumptions and their impact on the company's finances.

- Customization: our software adapts easily to a company's individual needs and supports its specific planning structures and processes.

4. Transparency and traceability

- Detailed analyses: by integrating and linking financial data, Corporate Planner provides deep insights into a company's finances, enabling detailed variance and root cause analyses.

- Audit trail and documentation: changes in financial data and plans can be precisely tracked, which increases transparency and ensures proof of data origin.

5. Real-time data availability and reporting

- Dashboards and real-time reporting: Corporate Planner provides clear dashboards that enable managers to monitor their KPIs in real time and respond quickly to new developments.

- Self-service reporting: users can easily create their own reports and analyses – even without in-depth IT knowledge – so they can quickly comply with their managers' individual requests.

6. Improved decision-making

- Sound analyses: Corporate Planner supports decision-making with complex analyses and simulations. The system can instantly process different scenarios and show their impact on the company's financial position.

- Forward-looking planning: Corporate Planner's predictive analytics and smart forecasting tools enable financial controllers to make a better assessment of future developments – for well-informed strategic decsions.

7. Excellent usability and flexibility

- Easy to use: Corporate Planner's intuitive user interface helps even the less tech-savvy users to master the software quickly.

- Easy to customize: our software adapts flexibly to a company's specific requirements with made-to-measure dashboards, reports and planning models.

8 Risk management and compliance

- Better risk management: Corporate Planner helps companies to identify financial risks at an early stage by continually monitoring liquidity ratios, gearing ratios and cash flow forecasts.

- Compliance support: Corporate Planner's structured data capture and processing helps companies to comply with legal requirements and internal guidelines for corporate governance and risk management.

9. Scalability and integration with other systems

- Scalability: Corporate Planner is fully scalable to the needs of medium-sized companies and major corporations alike.

- Connects to ERP and CRM systems: seamless integration with existing systems such as SAP, Microsoft Dynamics and other ERP systems ensures that all the relevant data is automatically included and can be used in corporate performance management.

10 Collaboration and teamwork

- Collaboration: Corporate Planner encourages collaboration between different departments by providing a common platform for planning, management and reporting. Teams can work together on financial plans, and everyone involved can easily track all variances and adjustments.

- Access rights and security: specific access rights can be assigned to different user groups to ensure that sensitive financial data is protected and only available to the persons concerned.

The benefits of Corporate Planner – in a nutshell:

- Increased efficiency through automation and simplified processes

- Improved planning with flexible rolling forecasts and scenario analyses

- Transparency and traceability thanks to a centralized data source and detailed reports

- Sound decisions based on real-time data and comprehensive analyses

- User-friendliness thanks to its intuitive operation and options for customization

- Flexibility and scalability thanks to standard integrations to source systems

Take your company's financial management to the next level with Corporate Planner – improve efficiency and transparency over the long term.