Operational management

The increasing complexity and dynamics of modern business processes are presenting more and more challenges in operational management. Companies need to respond to market developments in real time, so access to reliable financial, HR and operational KPIs is essential.

Make your company more agile. Corporate Planner provides you with tools for analysis, planning and reporting, enabling you to master the complex demands of operational management and get precise results more quickly.

Adapt flexibly to every new situation

-

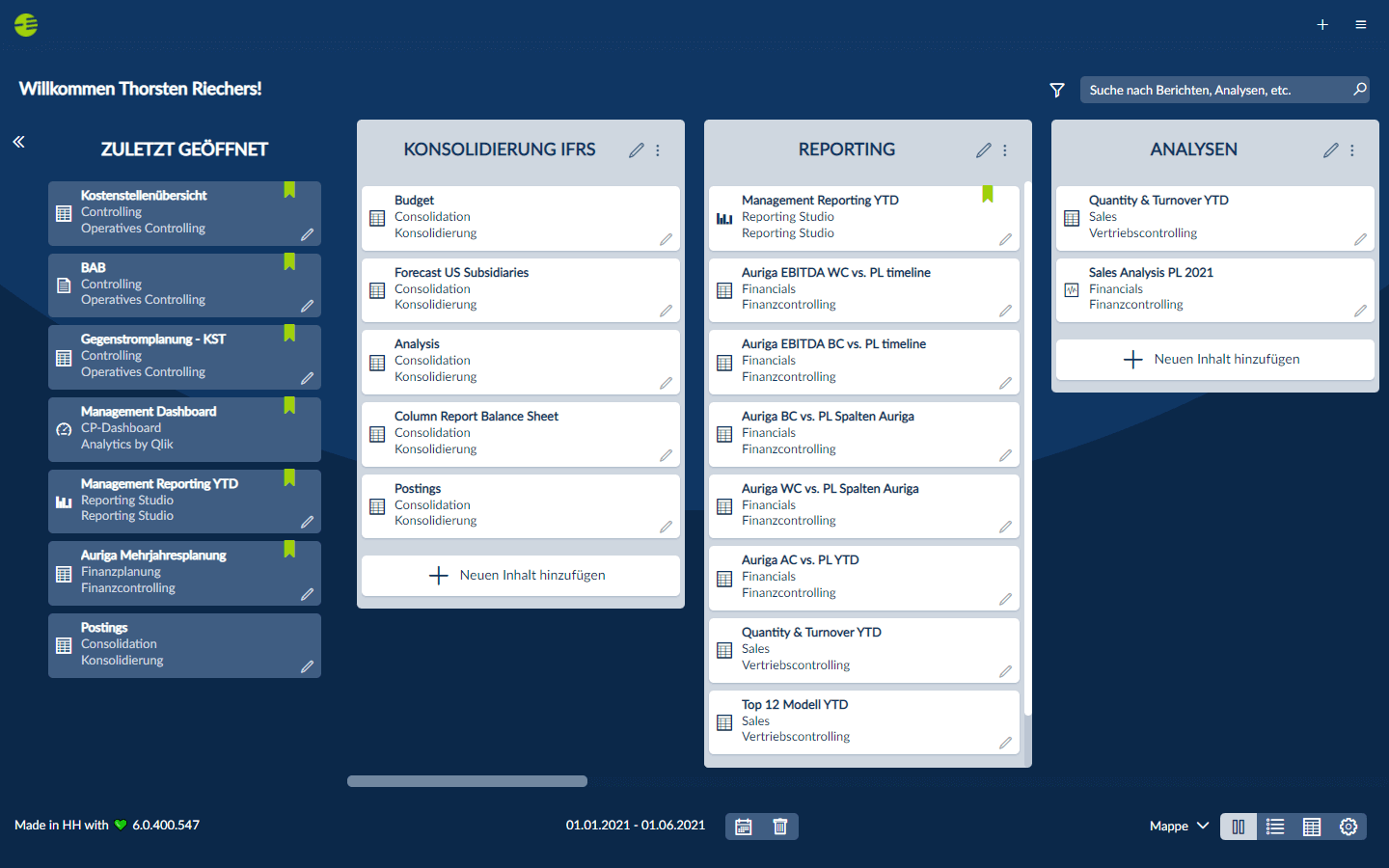

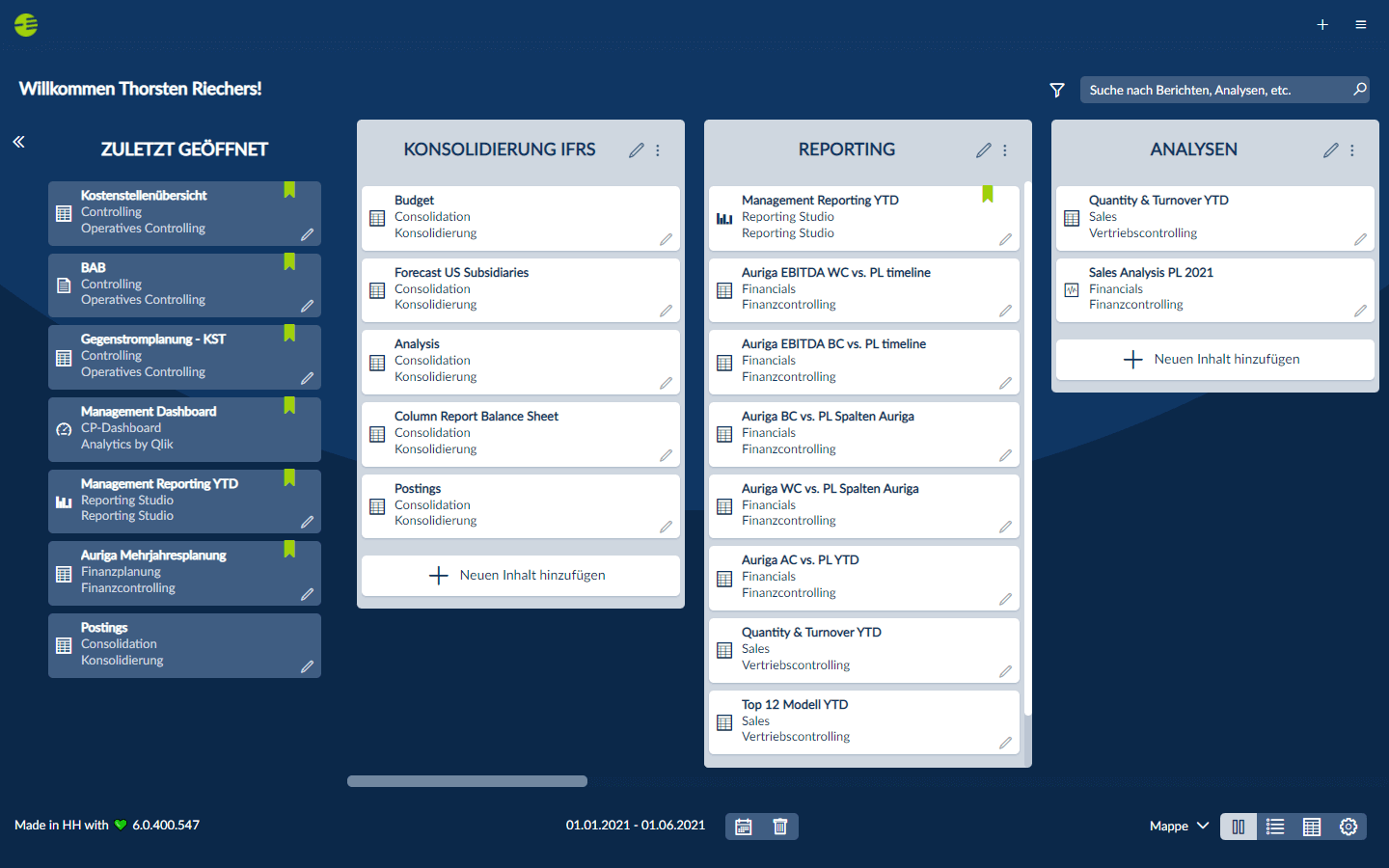

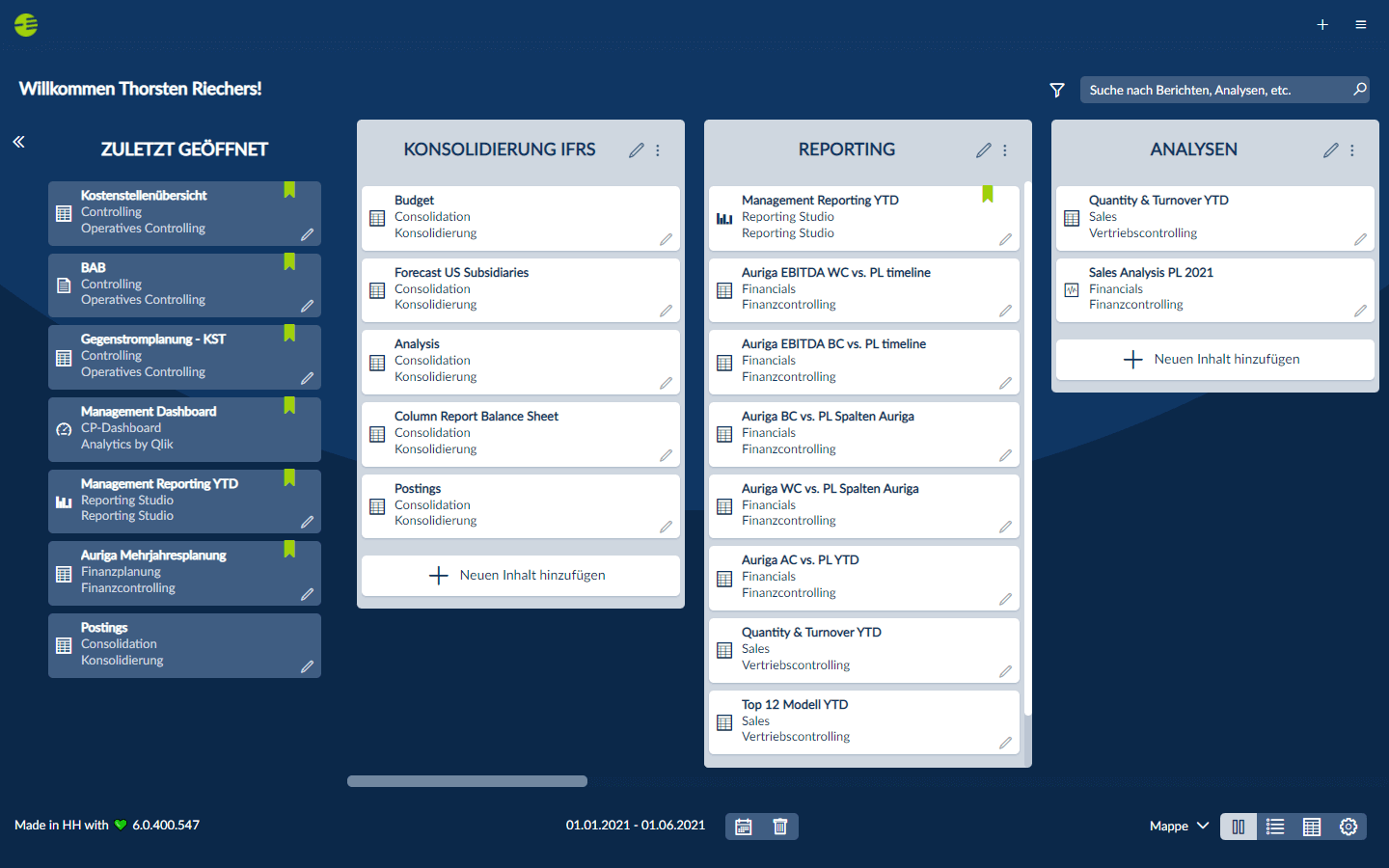

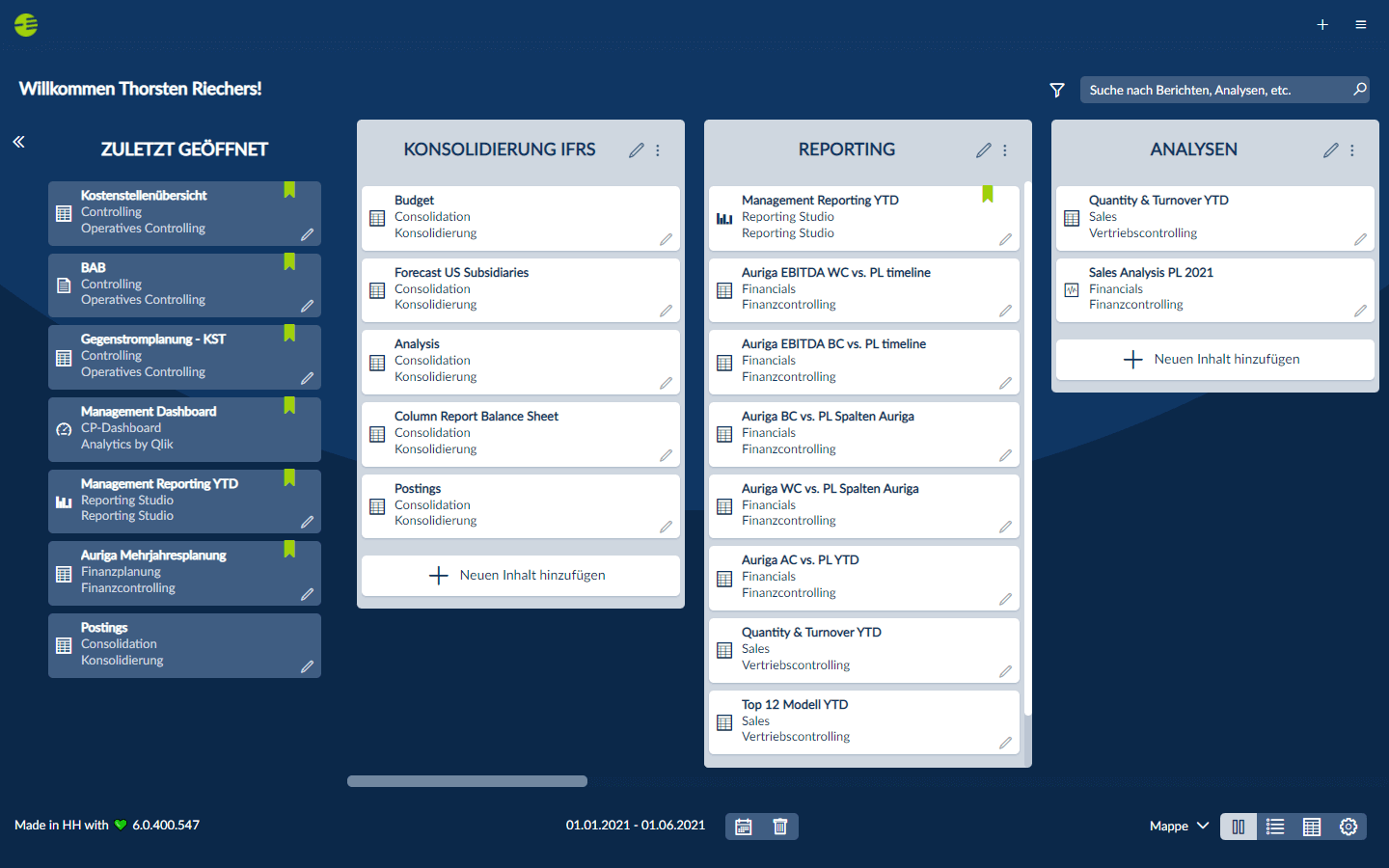

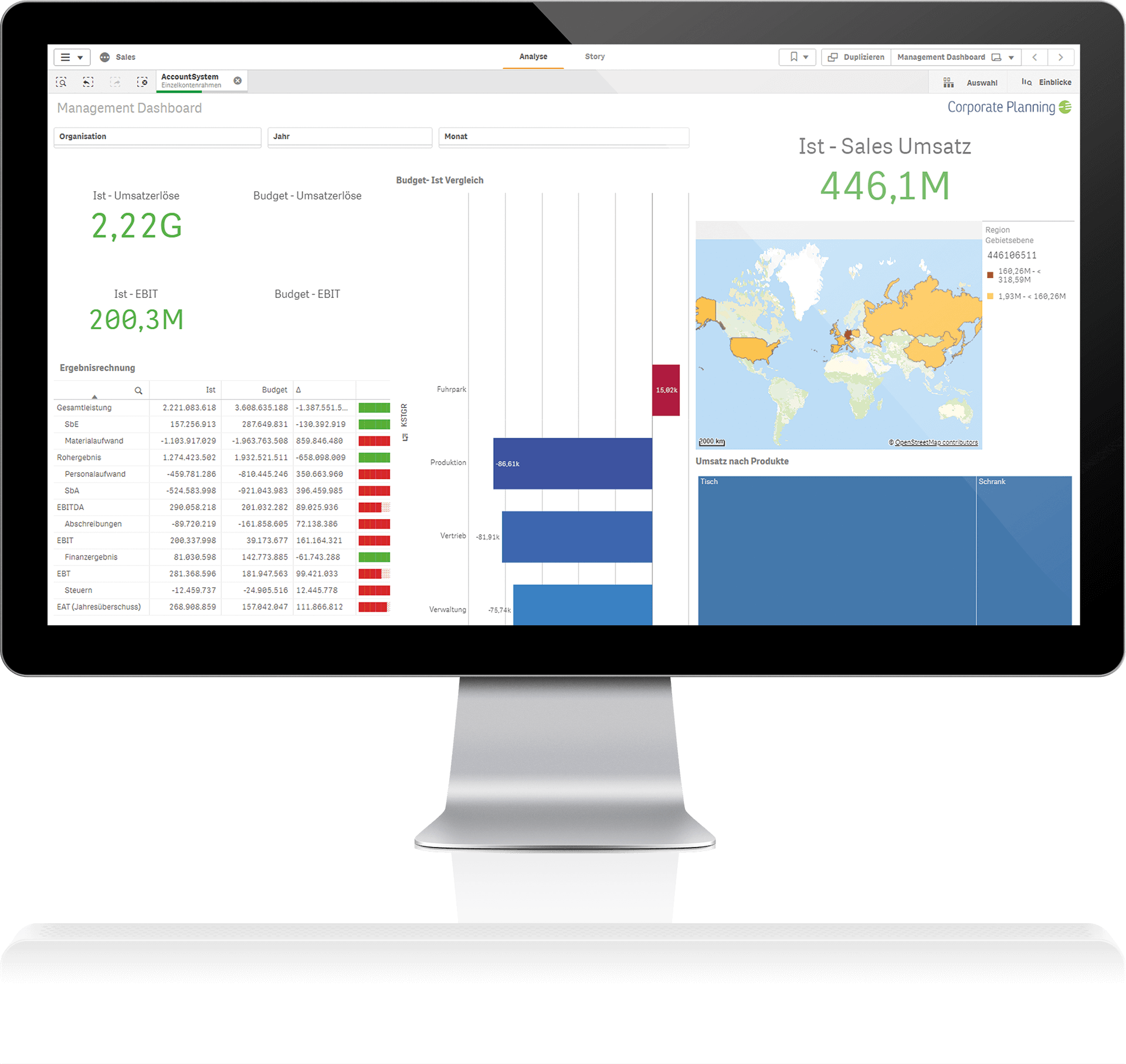

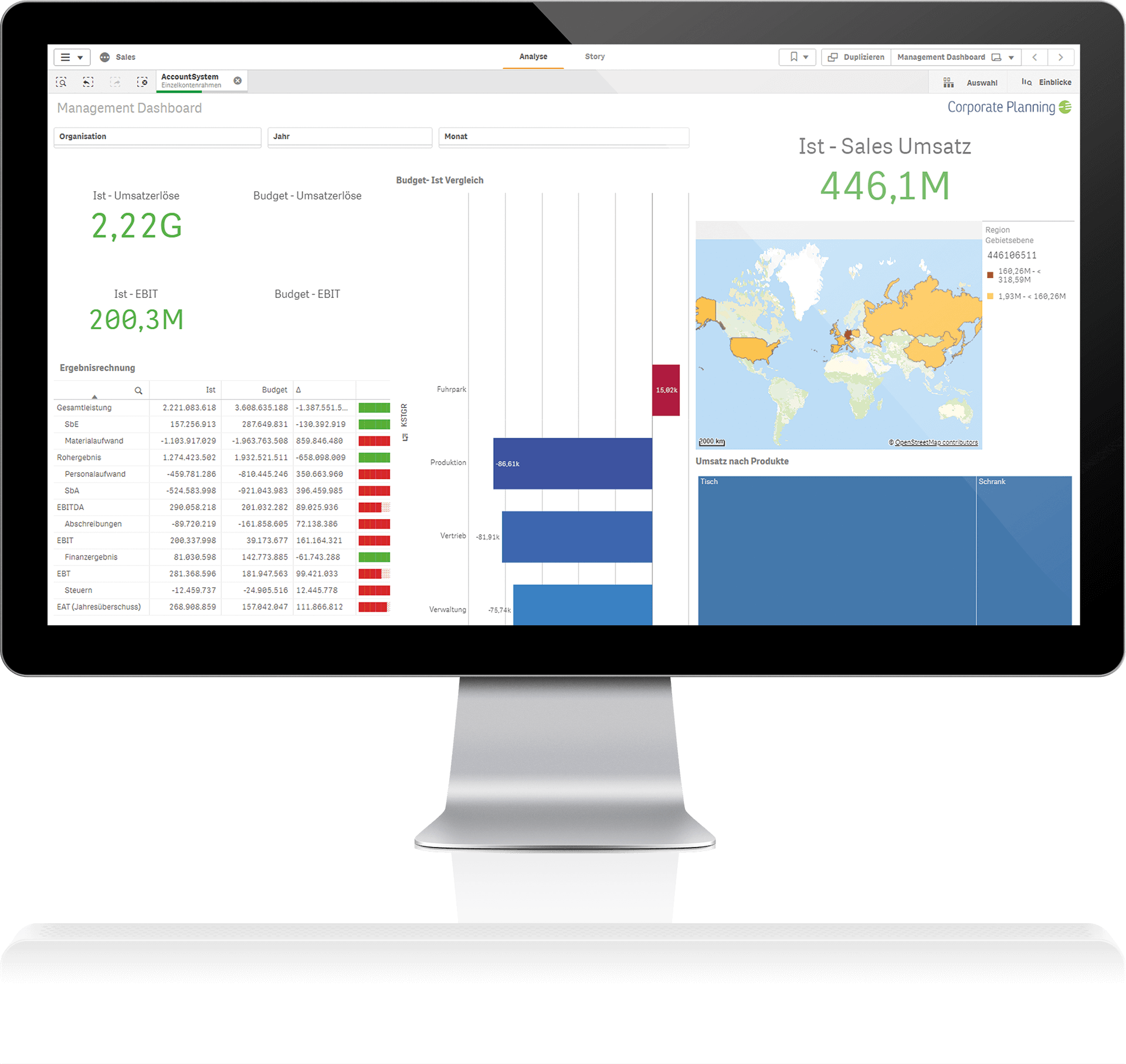

Corporate Planner

Corporate Planner comes with professional planning functions based on sound business management principles. Our software contains freely definable planning data streams, top-down and bottom-up planning, automatic forecasts, trend analyses, and much more besides.

×

Corporate Planner comes with professional planning functions based on sound business management principles. Our software contains freely definable planning data streams, top-down and bottom-up planning, automatic forecasts, trend analyses, and much more besides.

-

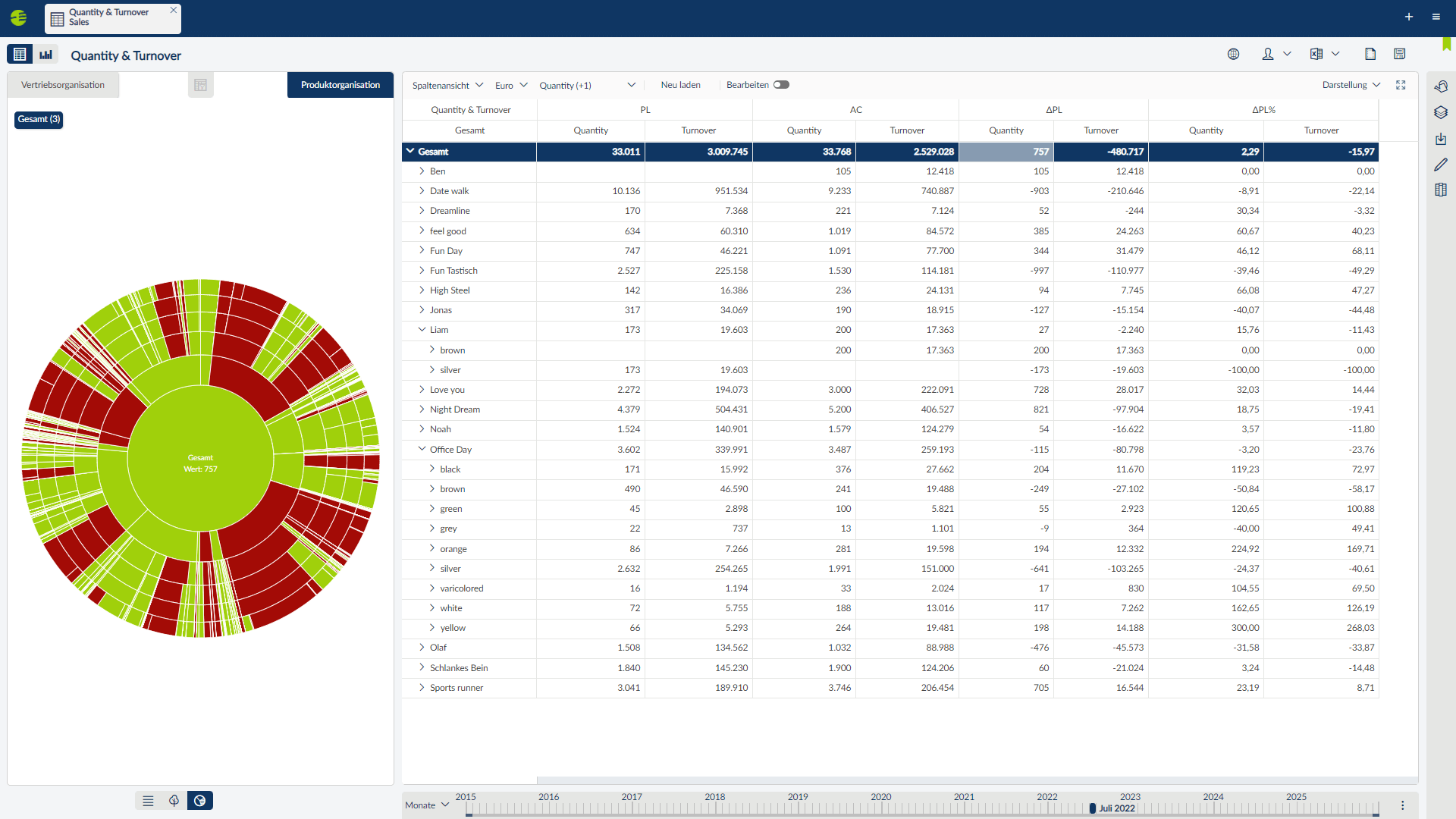

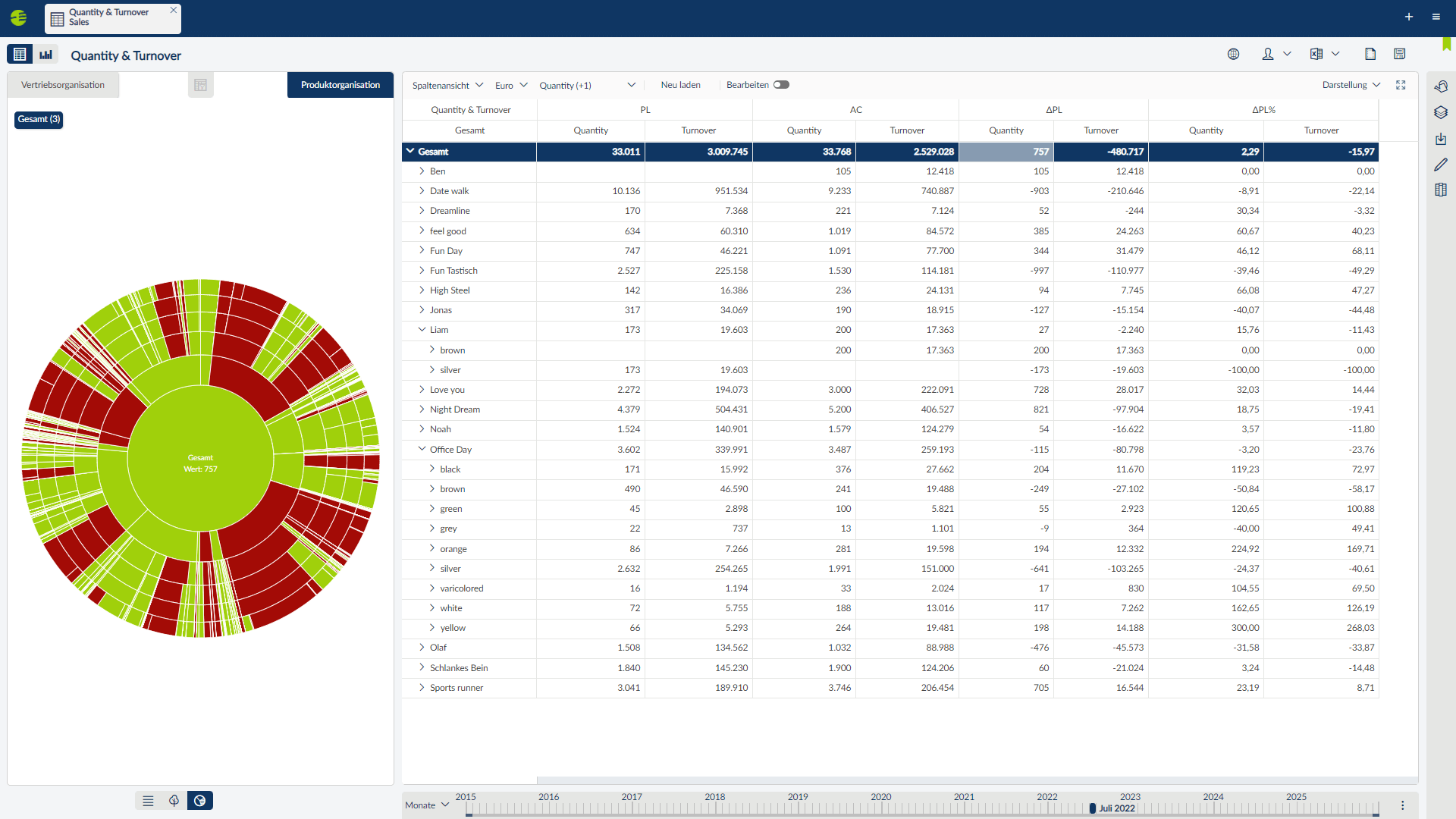

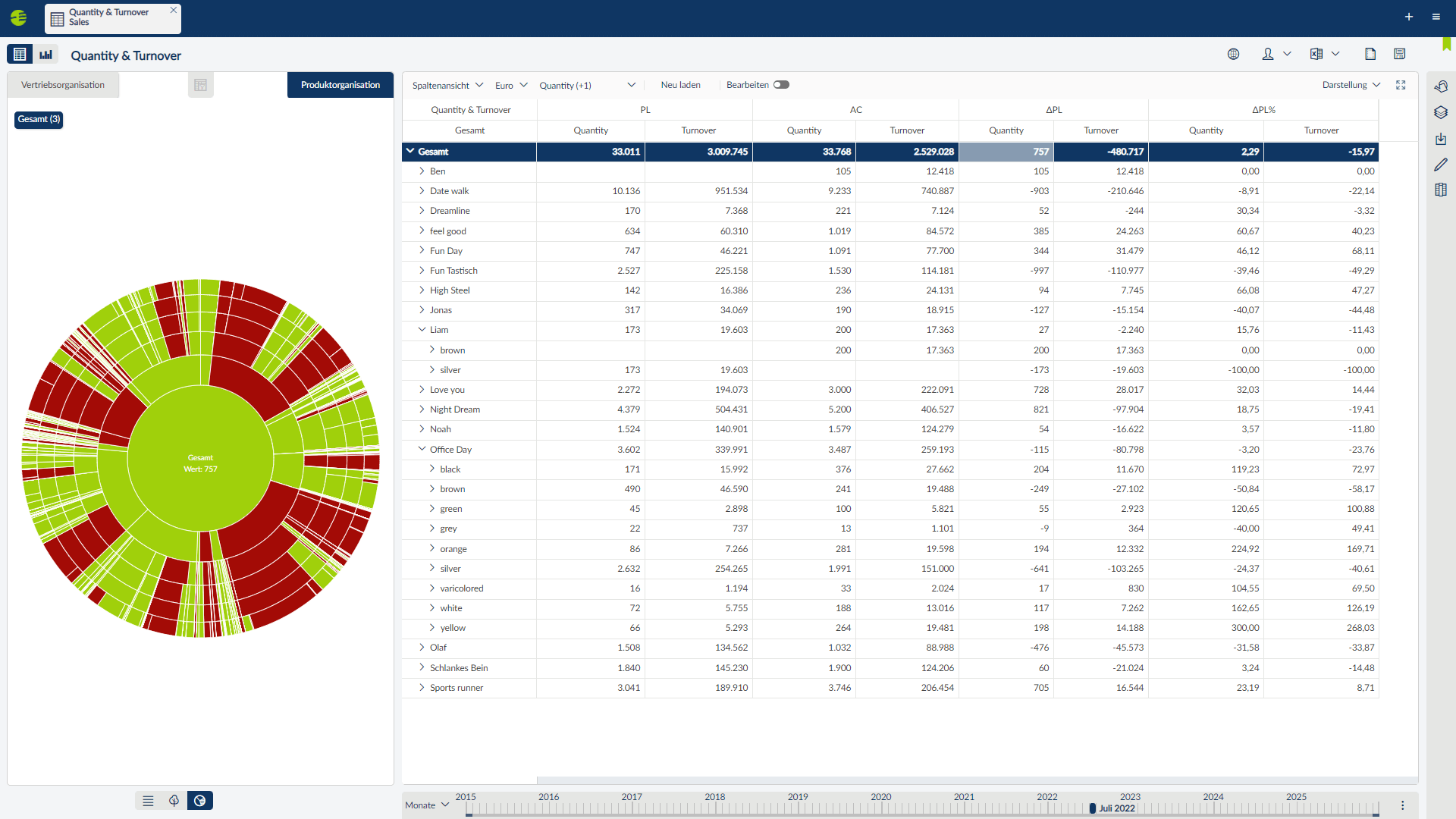

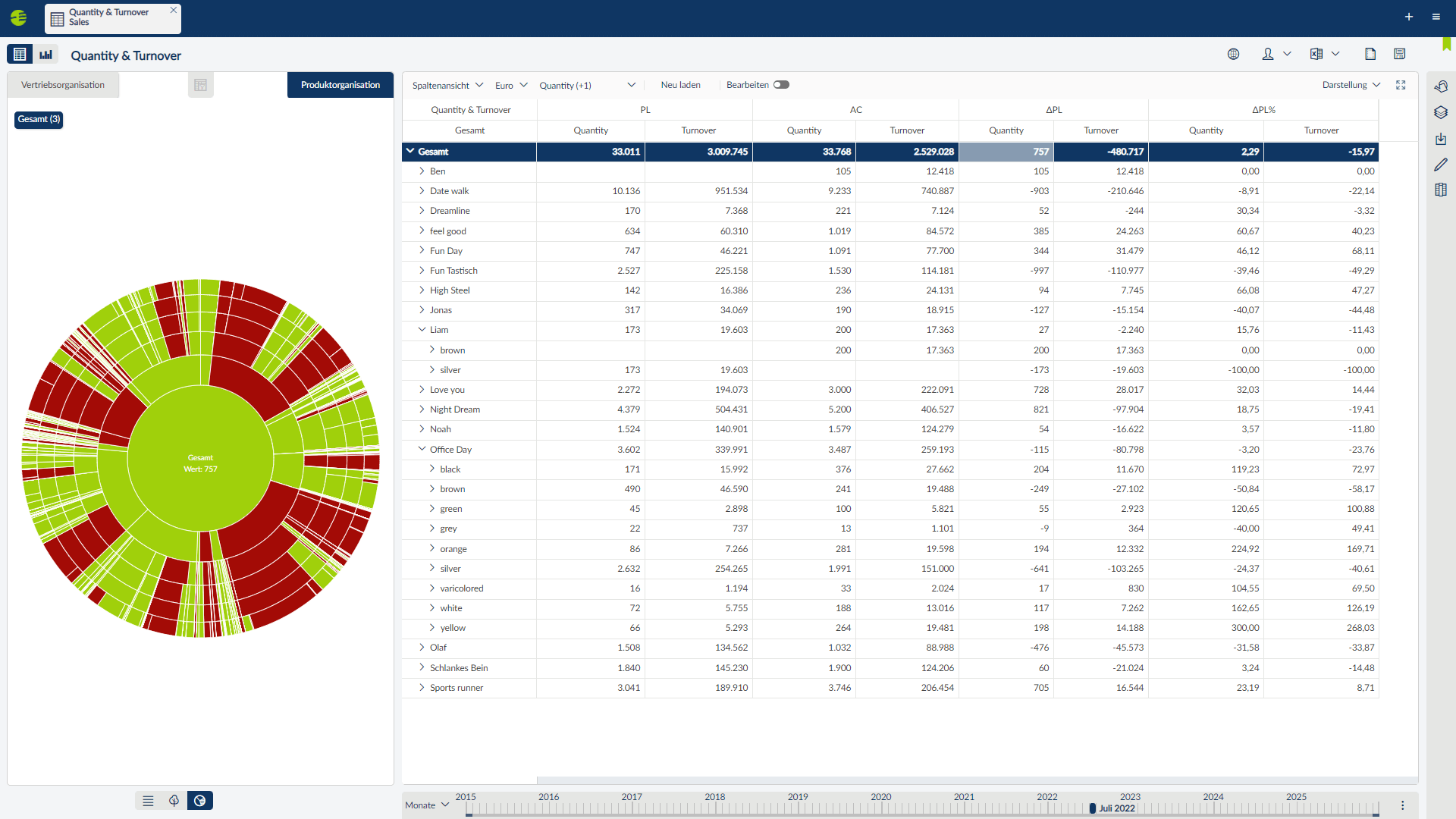

Sales Management sunburst chart

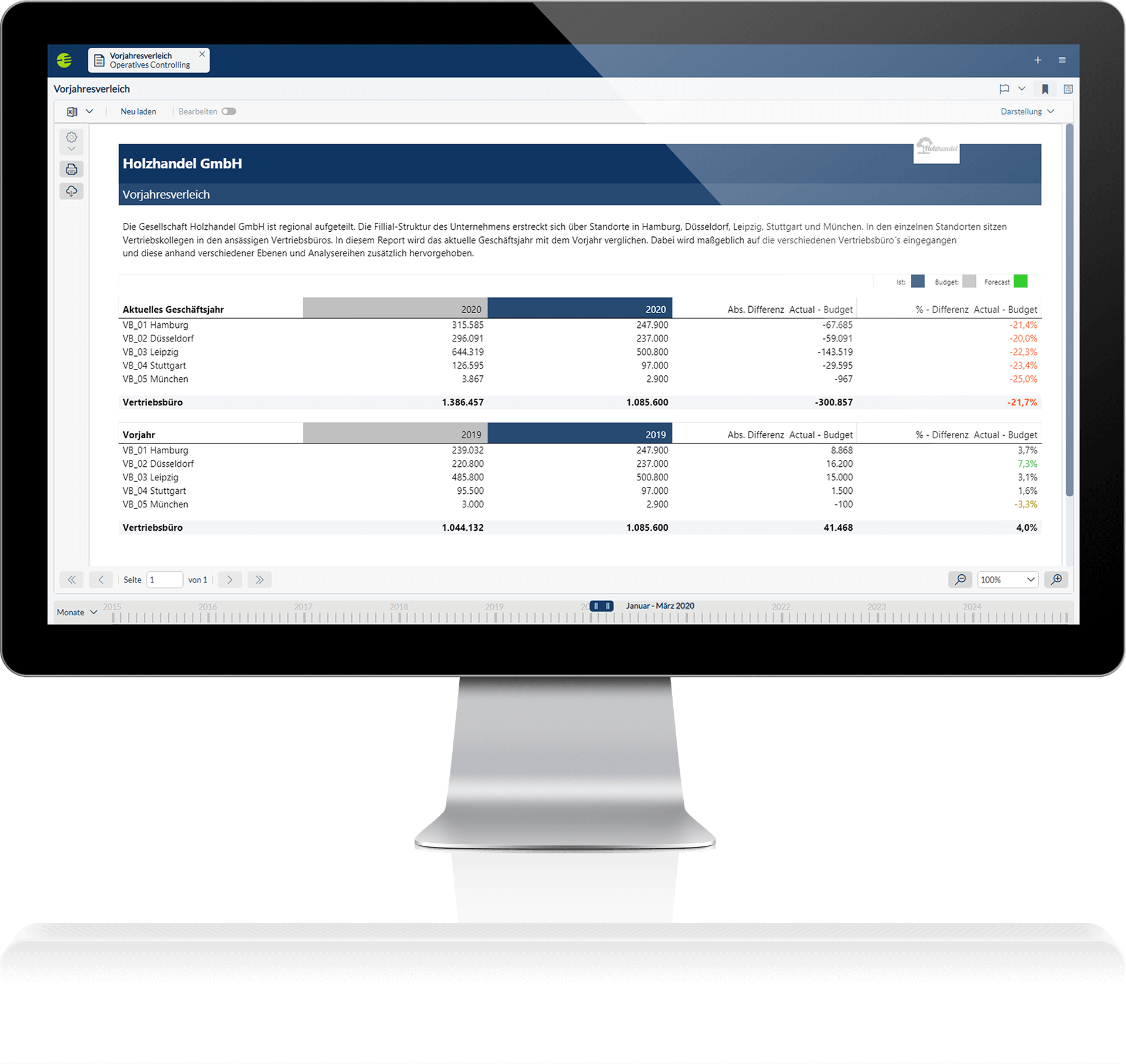

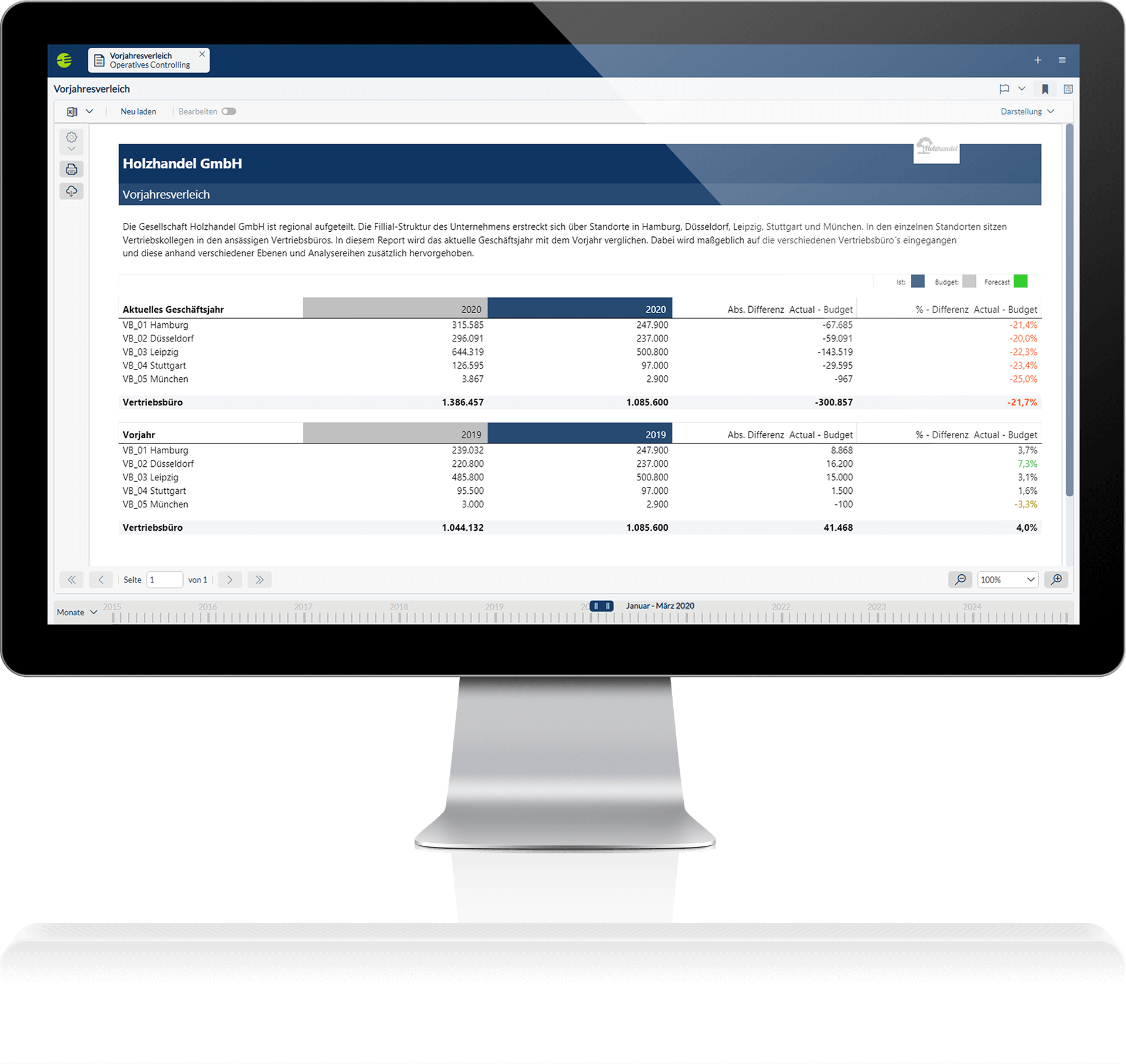

The Corporate Planner column view: variances are visualized in a sunburst chart.

×

The Corporate Planner column view: variances are visualized in a sunburst chart.

-

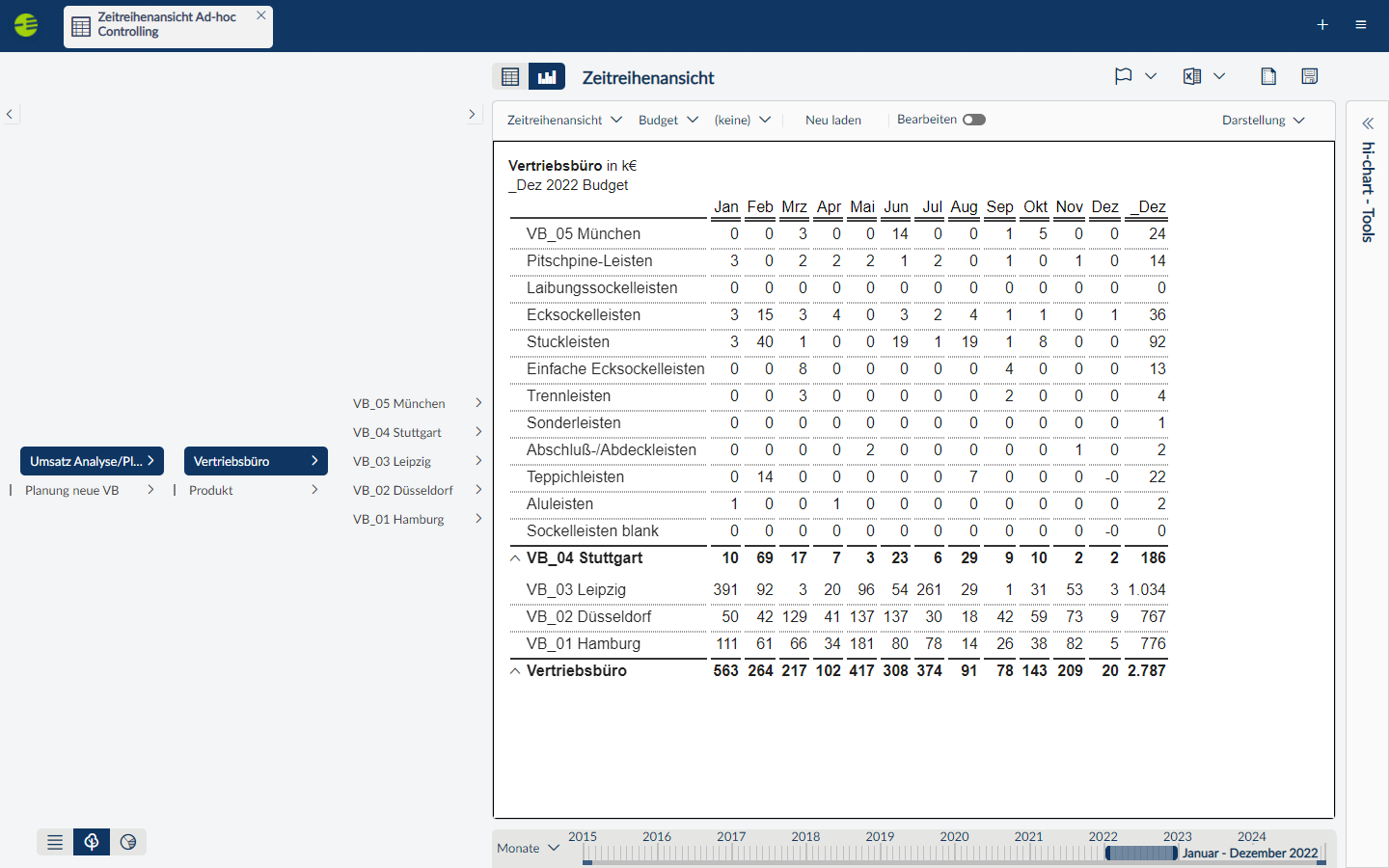

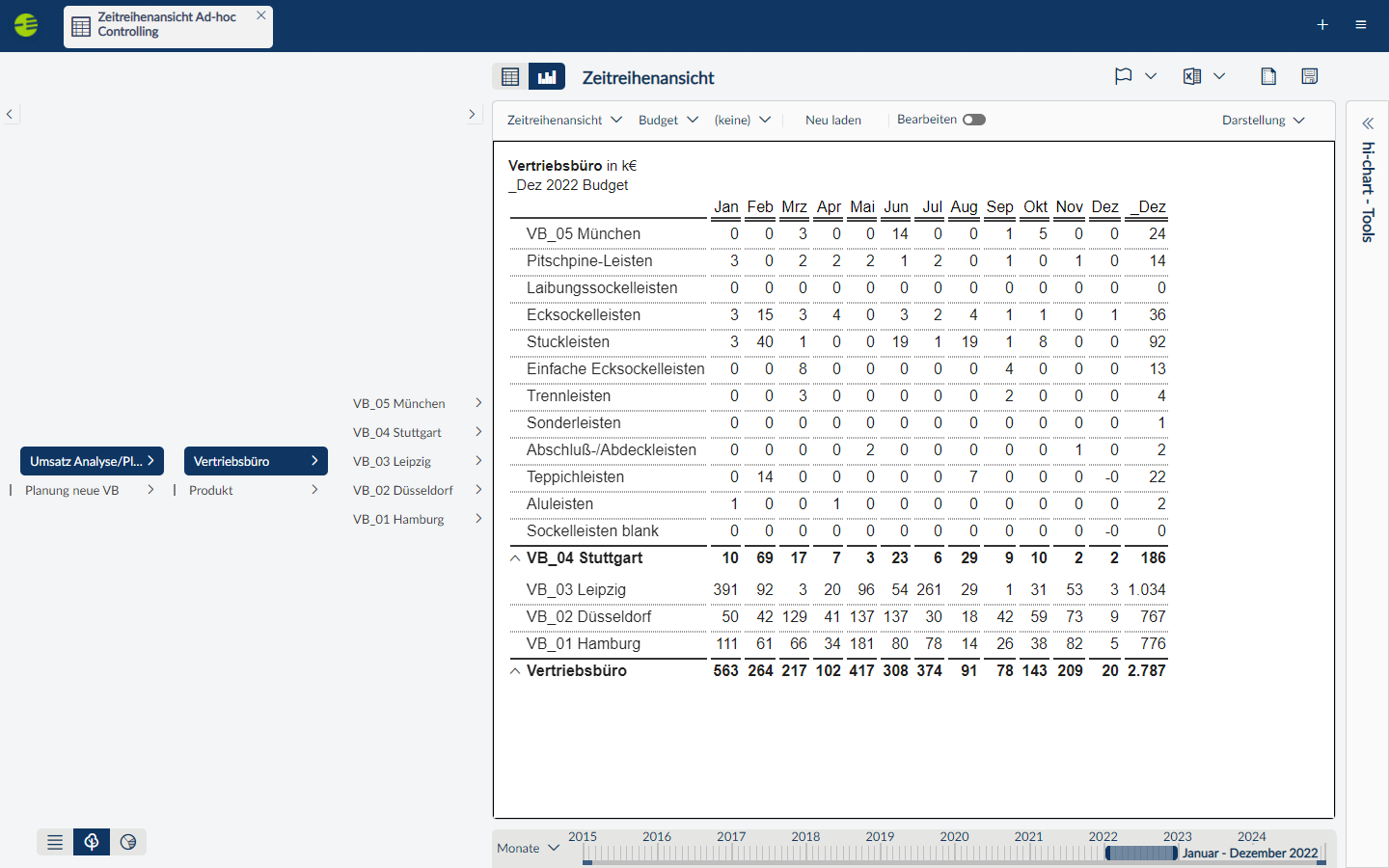

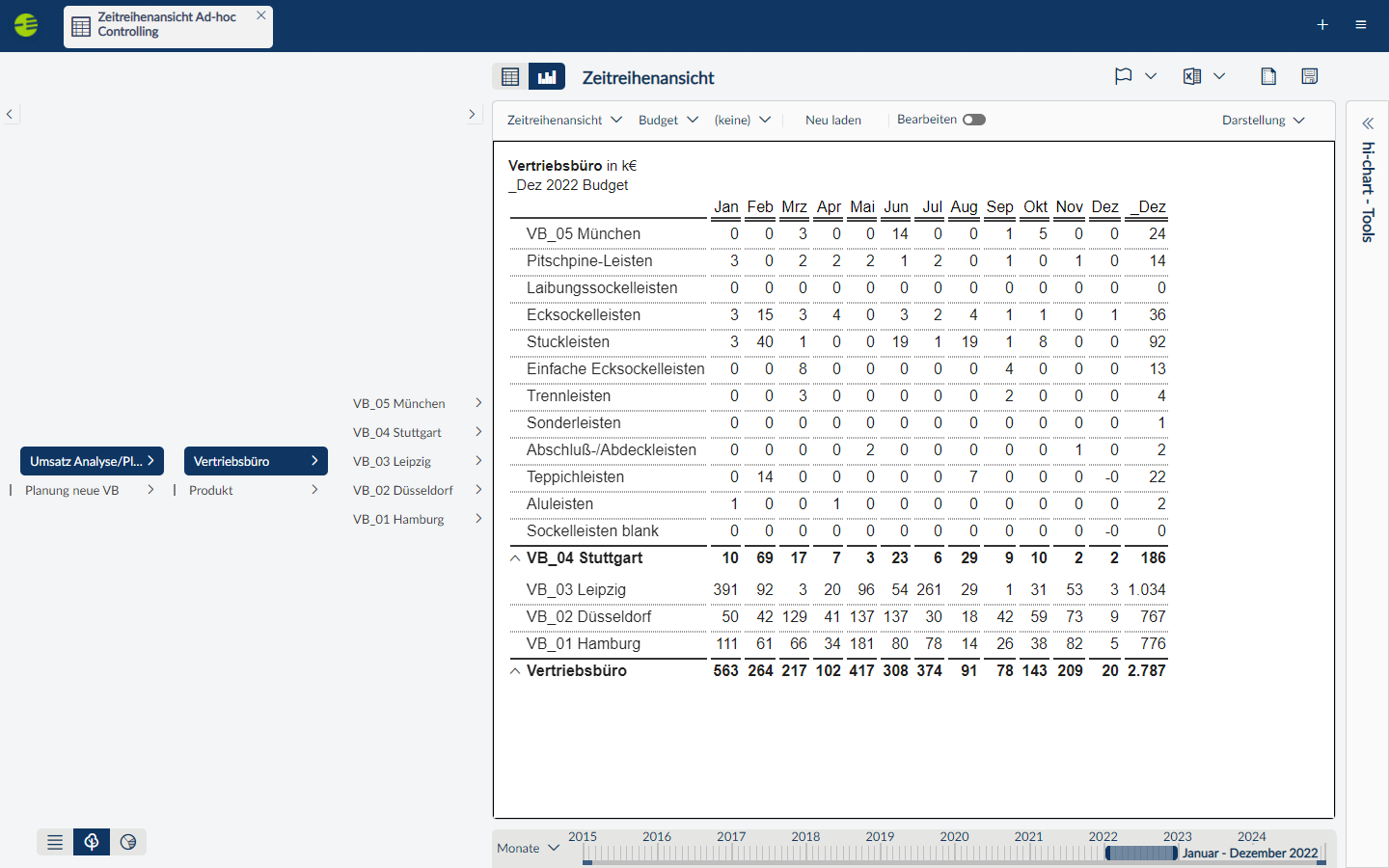

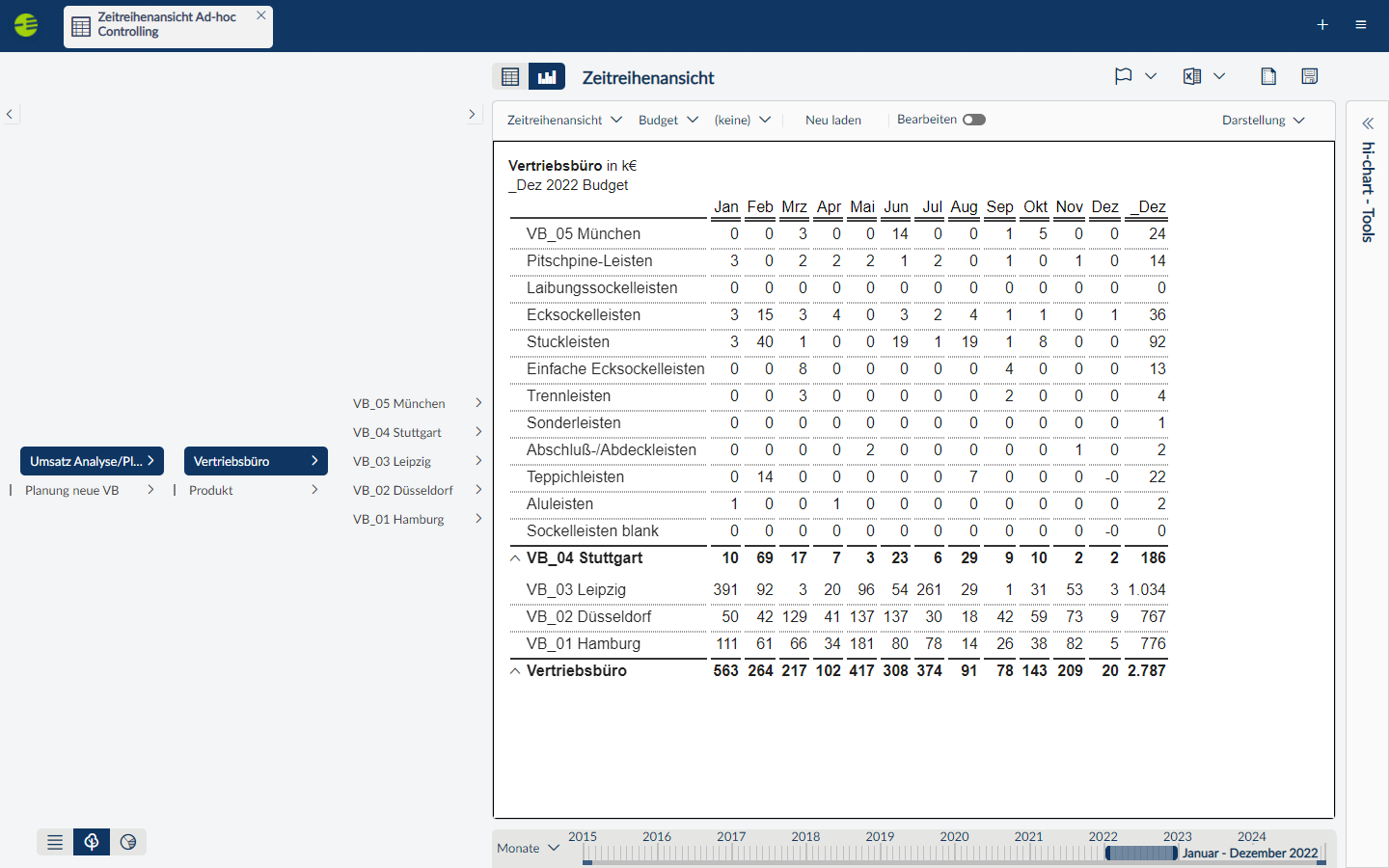

IBCS time series

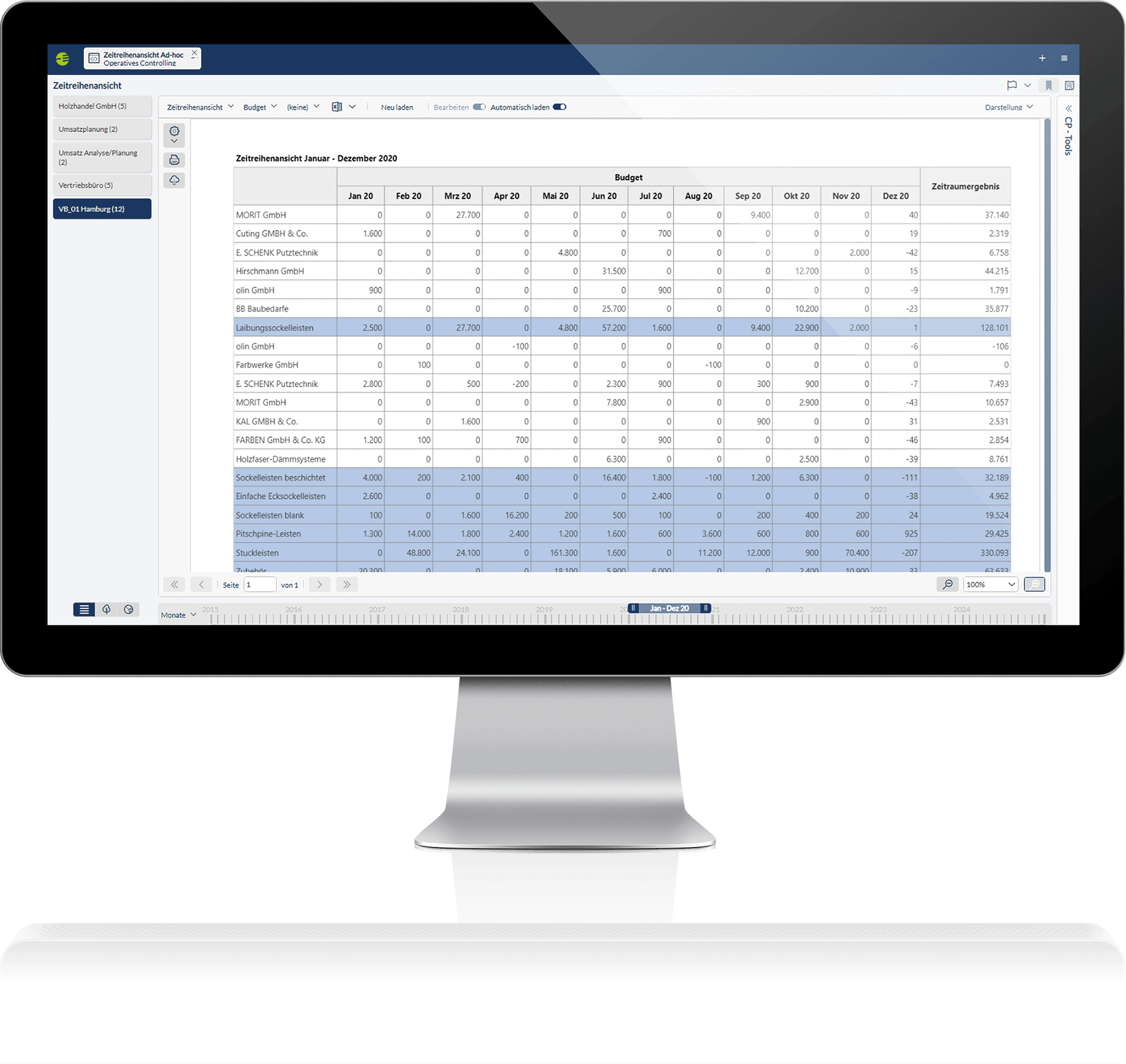

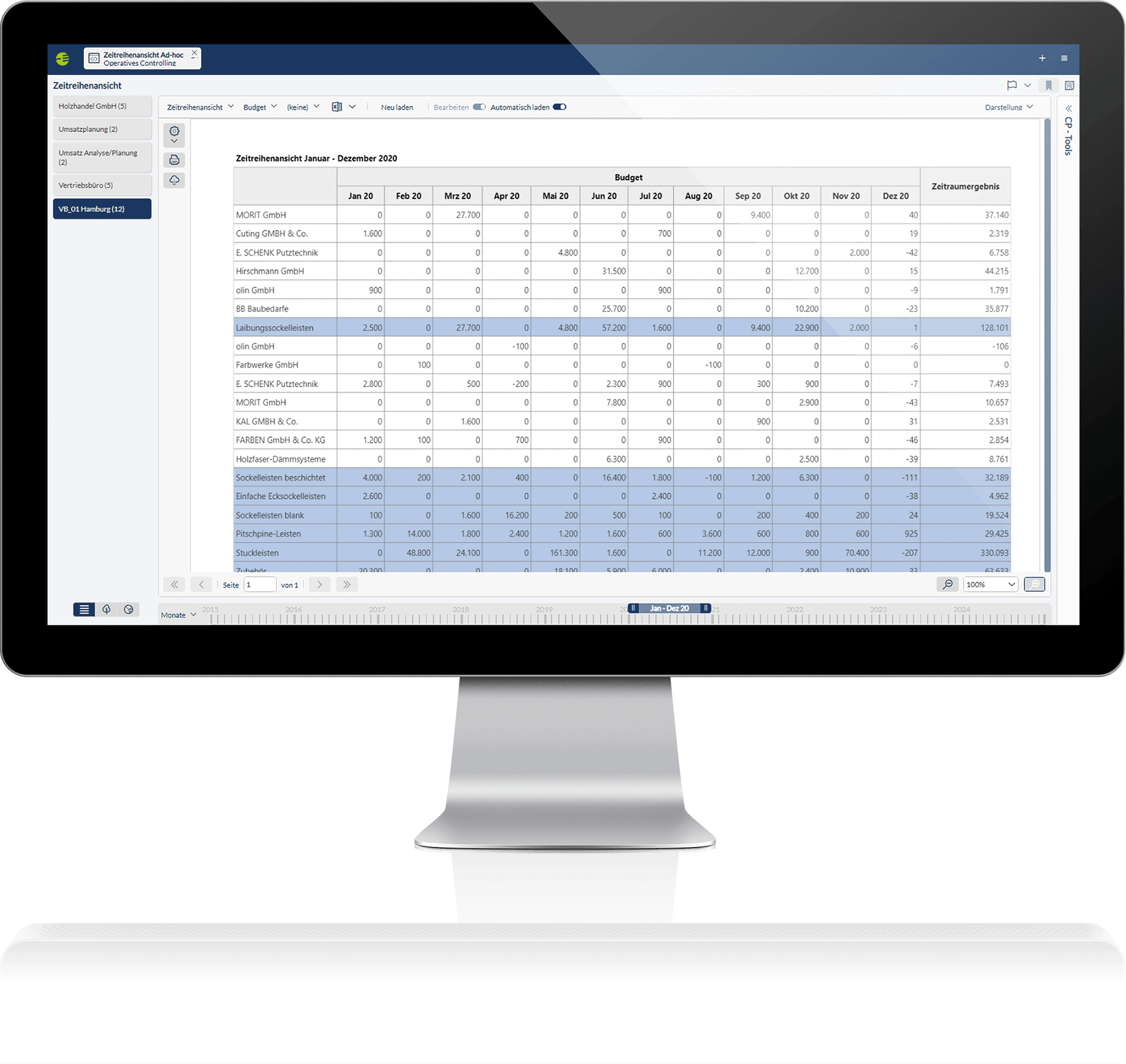

Here, embedded in our characteristic tree structure, you can see an IBCS time series view.

×

Here, embedded in our characteristic tree structure, you can see an IBCS time series view.

Corporate Planner comes with professional planning functions based on sound business management principles. Our software contains freely definable planning data streams, top-down and bottom-up planning, automatic forecasts, trend analyses, and much more besides.

Corporate Planner comes with professional planning functions based on sound business management principles. Our software contains freely definable planning data streams, top-down and bottom-up planning, automatic forecasts, trend analyses, and much more besides.

The Corporate Planner column view: variances are visualized in a sunburst chart.

The Corporate Planner column view: variances are visualized in a sunburst chart.

Here, embedded in our characteristic tree structure, you can see an IBCS time series view.

Here, embedded in our characteristic tree structure, you can see an IBCS time series view.

All areas of operational management

Cost management

Calculate contribution margins, identify potential savings and optimize cost structures. With Corporate Planner you can plan and monitor your cost centres and cost objects in detail.

HR management

Keep your focus on your most valuable resource – your employees. With Corporate Planner you can plan scenarios, anticipate staffing requirements in good time, and protect sensitive data with comprehensive access rights management.

Project management

Manage projects effectively using up-to-the-minute KPIs and ad-hoc analyses. With our software, you provide transparency and ensure your projects are successfully implemented on time and within budget.

Sales management

Respond quickly to market dynamics and optimize your sales processes using multidimensional analyses. Our software's smart reporting tools and flexible planning functions give you the insights you need to manage your sales organization efficiently.

Master the future of operational management with Corporate Planner.

Advantages of the Corporate Planning solution

Operational management, financial planning and reporting at Alpirsbacher Klosterbräu

100 employees, 20 different beers, 5,000 partners in catering and retail: watch this film to learn how the Alpirsbacher Klosterbräu brewery uses the Corporate Planner solution to navigate significant changes in the brewing industry.

Corporate performance management software

at work

What do the Corporate Planning software solutions deliver in practice? Nobody's better placed to tell us than the people working with them every day. Here's what some of our customers have to say.

The flexible, high-performance Corporate Planning software solution enables us to model all our processes and scenarios much more easily from start to finish. We were also impressed by the fact that no programming knowledge is required to create new reports.

Anja Tripolt

Head of Controlling, Schrack Seconet AG

The Corporate Planning software pools all our data sources and, thanks to its tree structure, provides a good overview. Navigation in the data sets is clear and simple, and KPIs for reporting can be set up quickly in a way that's easy to understand.

Elisabeth Kreuzer

Head of Finance and Legal Affairs, Brüder Theurl GmbH

We've been using Corporate Planner for more than twenty years. The solution is ideal in that it enables us to visualize new and increasing demands again and again. We greatly appreciate this flexibility and the ongoing development of the Corporate Planning software.

Stefan Dittmann

Senior Controller, digades GmbH

The Corporate Planning software is easy to use and also visually appealing. The business logic in Corporate Planner Finance enables a rapid rollout, so the software can be used straight away.